Solutions for Friends and Family Advisors

IBKR's Friends and Family Advisor solutions let you manage, trade and report on multiple accounts from a single master account and serve as a first step for advisors starting or growing their business.

Lowest Cost*

Our transparent, low commissions and financing rates, support for best price execution, and higher interest paid minimize your costs to help you maximize your returns.

Generate Higher Returns

IBKR offers lower commissions, no ticket charges, no minimums, no technology, software, platform or reporting fees, low financing rates and competitive interest paid on idle cash balances.

Learn MoreSupport for Best

Price Execution

IB SmartRoutingSM searches for the best firm stock, option, and combination prices available at the time of your order, and seeks to immediately execute your order electronically. IBKR Pro clients received a net US dollar price improvement of $0.43 per 100 shares vs. the industry bid / offer.

Learn MoreLowest Margin

Rates

We offer the lowest margin loan interest rates of any broker, according to the Barron's 2019 online broker review. Click below to calculate your own sample margin loan interest rate.

Learn MoreStock Yield

Enhancement Program

Earn income on your fully-paid stock shares in our Stock Yield Enhancement Program. The program lets us borrow your shares in exchange for cash collateral, and then lend the shares to traders who are willing to pay a fee to borrow them. You will be paid a loan fee each day that your stock is on loan.

Learn More*For more information, click here.

Lower investment costs will increase your overall return on investment, but lower costs do not guarantee that your investment will be profitable.

Your Gateway to the World's Markets

Invest globally in stocks, options, futures, currencies, bonds and funds from a single integrated account.

150Markets

34Countries

24Currencies

Access market data 24 hours a day and six days a week to stay connected to all global markets.

Convert currencies at market determined rates as low as 1/10 of a basis point, or create a position collateralized by a non-native currency.

Fund your account in multiple currencies. Trade assets denominated in multiple currencies from a single account.

Leverage Technology Built to Help You

Get Ahead

Powerful enough for the professional trader but designed for everyone. Available on desktop, mobile and web.

Spot market opportunities, analyze results, manage your account and make better decisions with our free trading tools.

100+ order types – from limit orders to complex algorithmic trading – help you execute any trading strategy.

Real-time trade confirmations, margin details, transaction cost analysis, sophisticated portfolio analysis and more.

Financial Strength and Stability

Our strong capital position, conservative balance sheet and automated risk controls are designed to protect IBKR and our clients from large trading losses.

Interactive Brokers Group (IBG LLC) equity capital exceeds $14.6 billion, over $10.2 billion in excess of regulatory requirements.1 25.4% of IBG LLC is owned by the publicly traded company, Interactive Brokers Group, Inc. and the remaining 74.6% is owned by our employees and affiliates.

Unlike other firms, where management owns a small share, we participate substantially in the downside just as much as in the upside which makes us run our business conservatively.

- Includes Interactive Brokers Group and its affiliates.

Open an Account

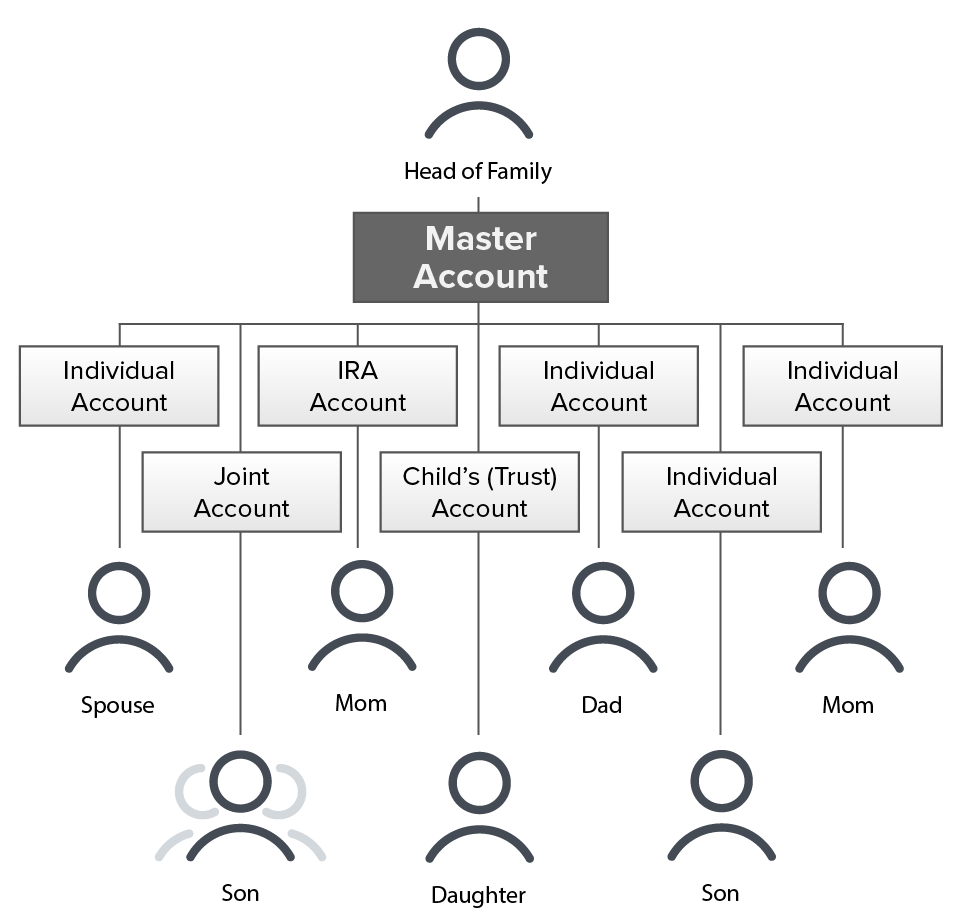

Manage 15 or fewer multiple accounts of varying types under a single login, including Individual, Joint, Trust, IRA, UGMA/UTMA, Corporation, Partnership, Limited Liability Company, and Unincorporated Legal Structures.

Friends and Family Account Structure

A master account linked to individual client accounts.

- The master account is used for fee collection and trade allocations.

- The advisor can open a single client account for his or her own trading.

Account Information

Only Advisors who are exempt from registration are eligible to open a Friends & Family account. Generally, most jurisdictions require that an advisor have 15 or fewer clients in order to qualify for exemption from registration. However, registration requirements can vary among jurisdictions. For example, advisors residing in the U.S. may be required to register under either State or Federal law if they meet certain criteria (e.g., total assets under management, number of clients, whether they receive compensation, etc.).

Advisors whose Registered Independent Advisor registrations are pending or who aspire to become RIAs can open a Friends and Family Group account and then, when their registration is complete, upgrade their account to a Registered Investment Advisor account by entering information about their securities and/or commodities registration on the Advisor Qualifications page in the Advisor Portal.

Must be 21 or older to open a margin account, 18 or older to open a cash account.

Accounts are accepted from citizens or residents of all countries except citizens or residents of those countries or regions that are on the sanction list of the US Office of Foreign Asset Controls or similar lists, or other countries determined to be higher risk. See all available countries.

A UGMA/UTMA account is intended for a custodian of a minor who is a US resident, and is available as a Cash account only. Minimum deposit is 3000 USD or non-USD equivalent and the monthly activity fee for age 25 or younger applies. A UGMA/UTMA account is a single account with a default single user (the custodian), and up to five Power of Attorney users can be added. The minor for whom the account is opened must be a US legal resident and a US citizen.

Please note that monthly activity and other minimum fees may apply.

For information on SIPC coverage on your account, visit www.sipc.org or call SIPC at 1 (202) 371-8300.